Empowering Financial Freedom: Pilou’s Journey with Nolte

Expertise

- Product Strategy

- Product Management

- Engineering

- Product Design

Platforms

- Web

Products

- Web App Design

About the Company

- FinTech

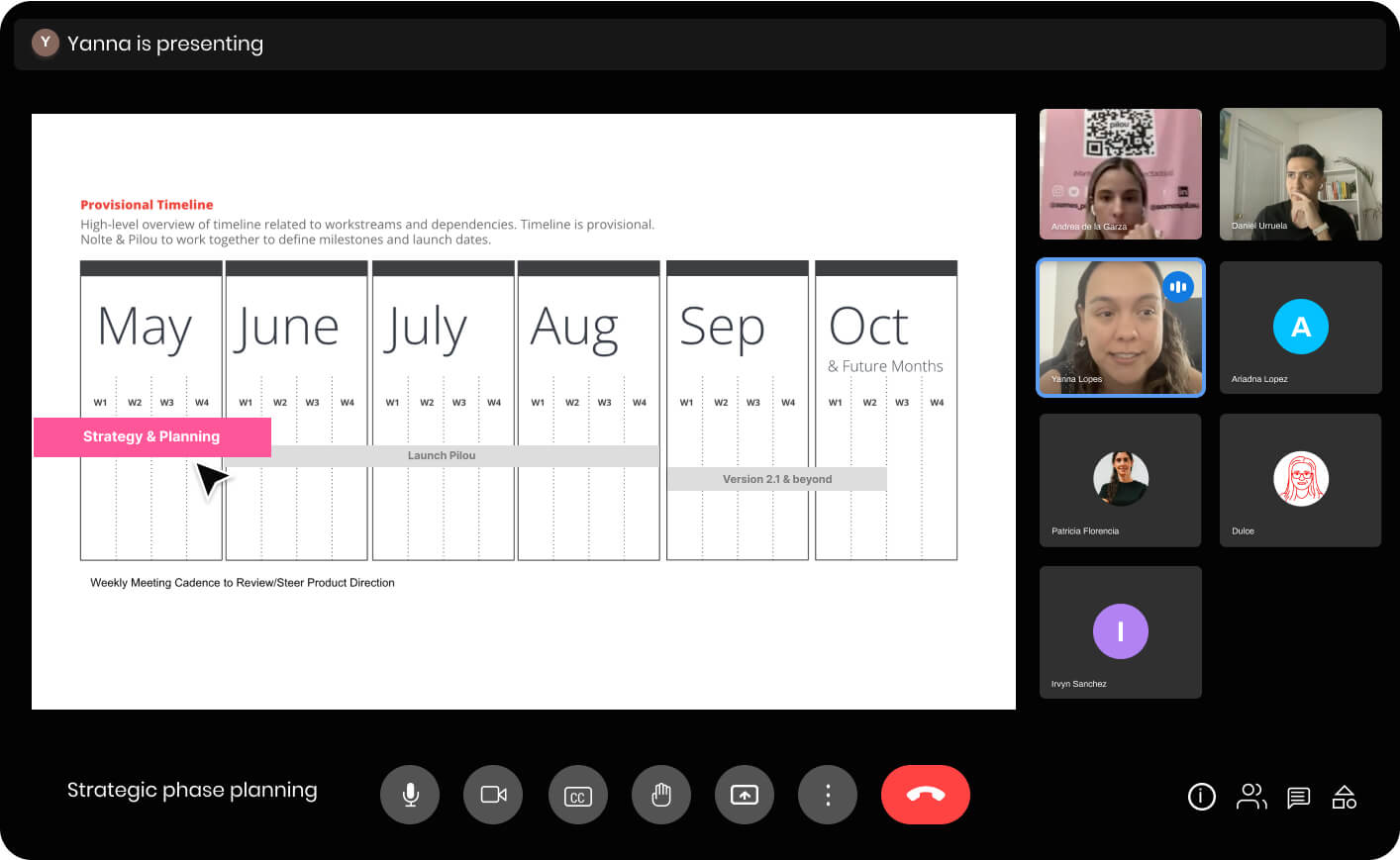

In Mexico’s fintech sector, Pilou stands out for its forward-thinking approach. More than just a financial platform, Pilou is a tool for financial empowerment, especially for those traditionally overlooked in finance. This mission was energized in May 2023 with Pilou’s partnership with Nolte. This collaboration began with a meeting between Pilou’s founders, Andrea de la Garza and Patricia Florencia, and the Nolte team, which included a Head of Digital Product with a proven track record in fintech startups in Brazil and extensive experience in elevating early-stage digital products. This leader’s mission was to guide the Nolte team through the complex process of refining and advancing Pilou’s platform, leveraging a wealth of experience to drive innovation and quality.

The Genesis: Identifying Challenges and Setting Goals

Our journey with Pilou began with a detailed discussion about their goals for 2023. Although Pilou had made significant strides in the fintech sector, they faced a major hurdle: their technology strategy was unclear for them, made more complex by the input of various engineers over time. Our goal was straightforward – to assess and improve their existing digital product, tailoring our solutions to support Pilou’s immediate and future business objectives.

We initiated our collaboration by dissecting Pilou’s legacy code. Our tech, product design, and digital product assessments unveiled several areas for improvement, which lead us to focus on areas such as improving the platform’s scalability, enhancing documentation for better clarity, streamlining the management of technical settings, and bolstering overall code quality and security. We also identified an opportunity for automated testing, enhanced system consistency, better error monitoring, and a more user-friendly interface. This initial assessment approach ensured that our improvements were both constructive and aligned with Pilou’s growth trajectory.

Strategy and Planning: Charting the Course

Following our detailed evaluation of Pilou’s system, we dedicated a focused month to strategizing and planning. This phase was more than just a procedural step; it was a deep dive into understanding Pilou’s market, user needs, and brand positioning. We employed targeted digital product discovery techniques and tools, not just to gather information but to shape a concrete digital product release plan based on a detailed backlog and a roadmap with timelines, carefully crafted to ensure a smooth product development and product delivery phase. Our goal was to minimize risks and prioritize Pilou’s market entry in the most effective and secure manner, ensuring that every step taken was aligned with both immediate needs and long-term business objectives we had identified in the previous assessment phase.

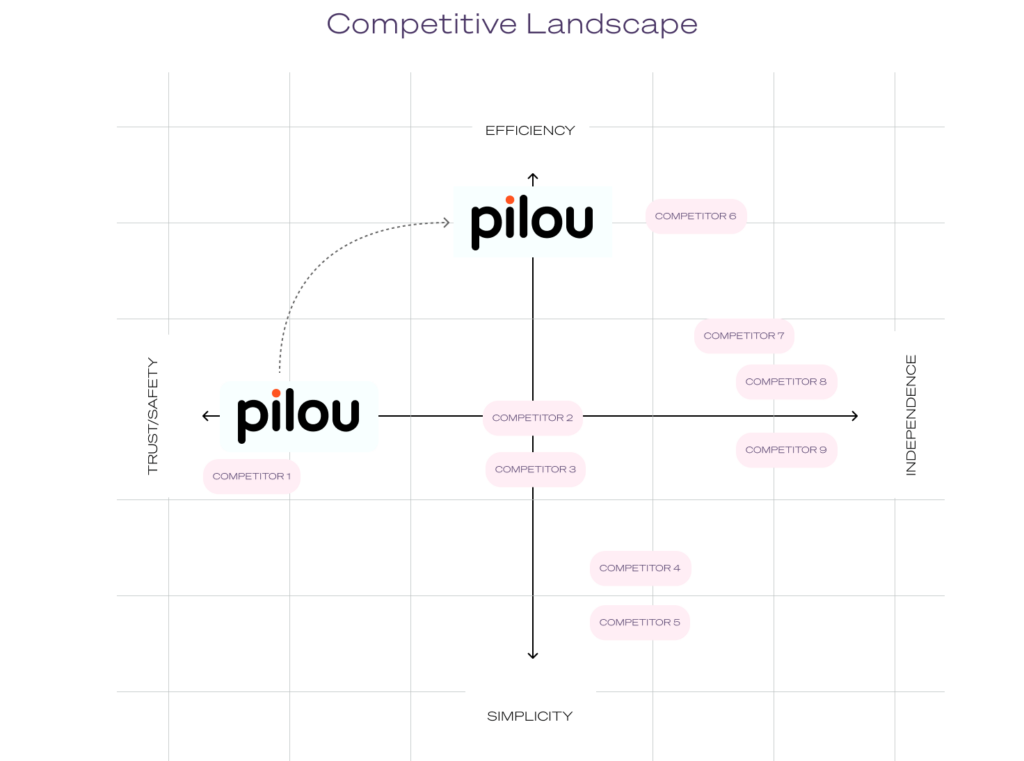

During this period, our exploration into Pilou’s competitive environment was more than just a routine analysis. We closely examined over six direct competitors, assessing their strengths, weaknesses, market positions, and key features. This wasn’t just to understand the competition but to identify where Pilou could differentiate and excel. Simultaneously, we engaged directly with Pilou’s users, gathering vital demographic and qualitative data trough survey answers. This dual approach was crucial for Pilou. It gave us a complete picture of where they stood in the market and, more importantly, what their users truly needed and wanted. This information was pivotal in shaping Pilou’s strategy to not only meet but exceed market and user expectations.

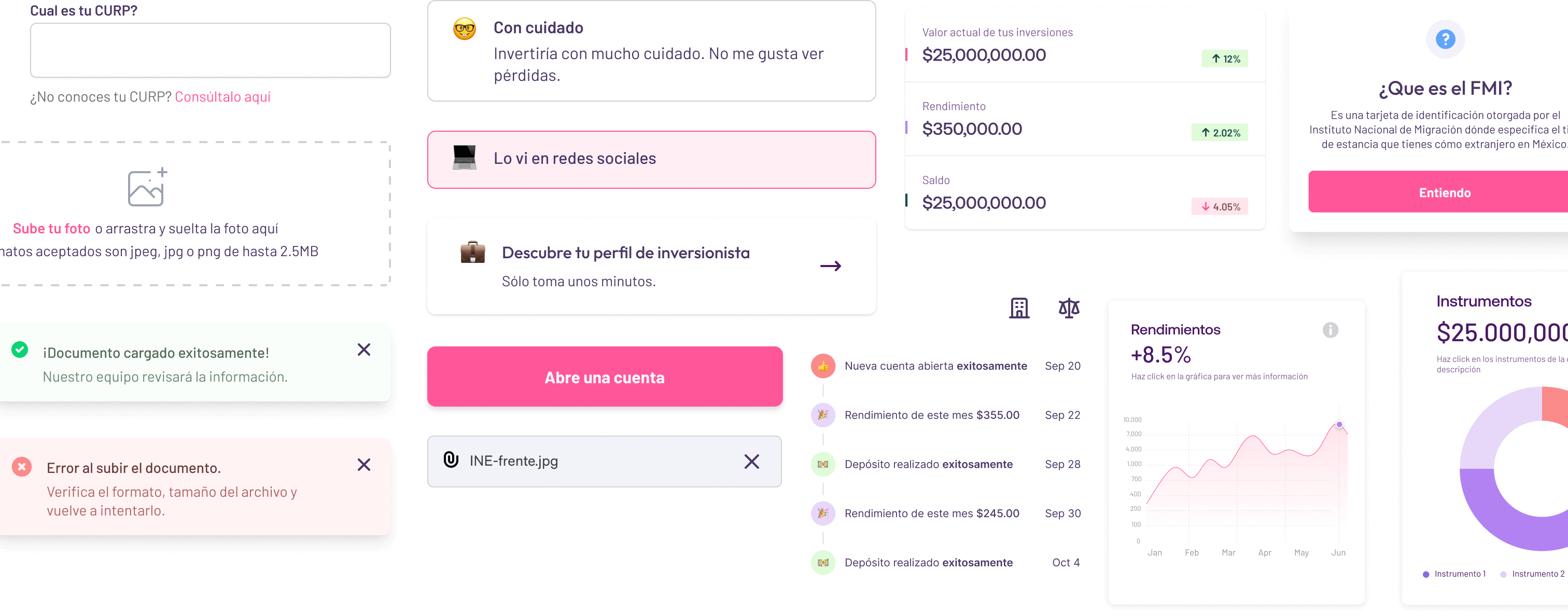

Secondly, we turned our attention to the product redesign of Pilou’s user interface a key strategic decision, informed by a detailed analysis of user interactions with their platform. We revamped the look with a new color palette and design elements that aligned with Pilou’s brand identity. More crucially, we identified and addressed areas where the user experience was lacking, focusing on enhancing both the aesthetic and functional aspects of the interface.

By introducing the Example Mapping methodology to Pilou, we established a collaborative and efficient framework for extracting business rules. This approach was designed to streamline communication and minimize delays in the market launch. Working closely with Pilou’s team, we ensured that our efforts were not only about upgrading the visual appeal but also about making practical, user-centric enhancements that would directly contribute to achieving Pilou’s business objectives.

These meticulous preparations in understanding the market, the needs and reshaping the user experience set the stage for the next critical phase: implementation. Armed with these insights and strategies and again, with a strategy carefully designed to mitigate potential risks – we were now ready to transition into the practical application of our plans, turning our collaborative vision into a tangible reality for Pilou.

Implementation: Rebuilding and Enhancing – A new chapter for Pilou

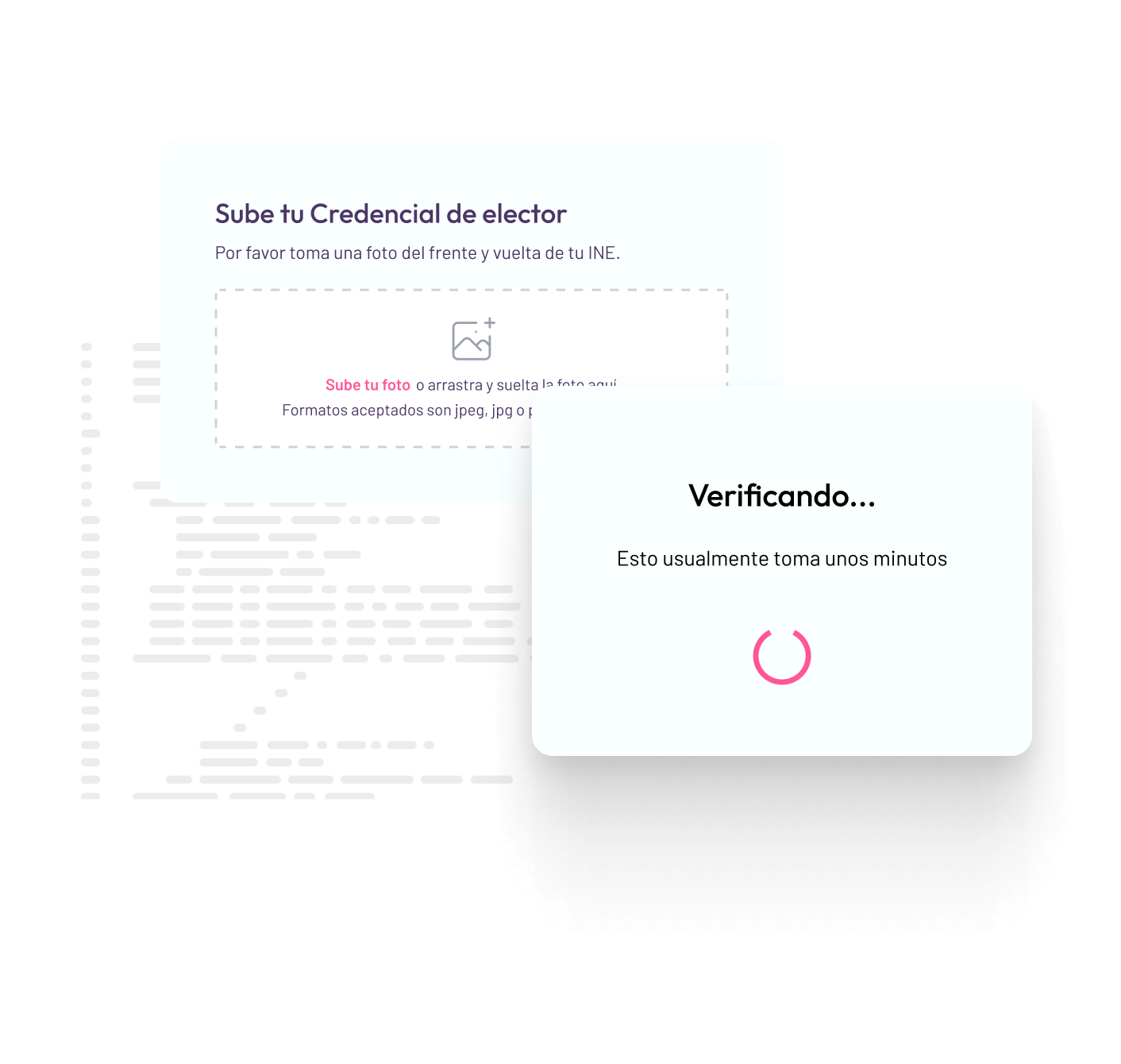

As we concluded the discovery phase, it became evident that the most impactful area for immediate improvement was Pilou’s user onboarding process and the entire Know Your Customer (KYC) system. Both teams – Pilou and Nolte – agreed to focus in this flow because this is where every customer’s journey with Pilou begins. It’s the crucial first touchpoint, setting the tone for the user’s entire experience; and since our initial assessment we had identified key issues in the existing onboarding process, which were validated during the strategy and plan phase. These issues, if unresolved, posed a risk of losing potential clients right at the start of their journey.

By revamping this critical entry point with a modern, more robust tech stack, we aimed to significantly enhance Pilou’s scalability and user satisfaction. Our Product Release goal was clear: to ensure a seamless, engaging first interaction that would lead to higher conversion rates and lay a strong foundation to increase retention and long-term customer relationships.

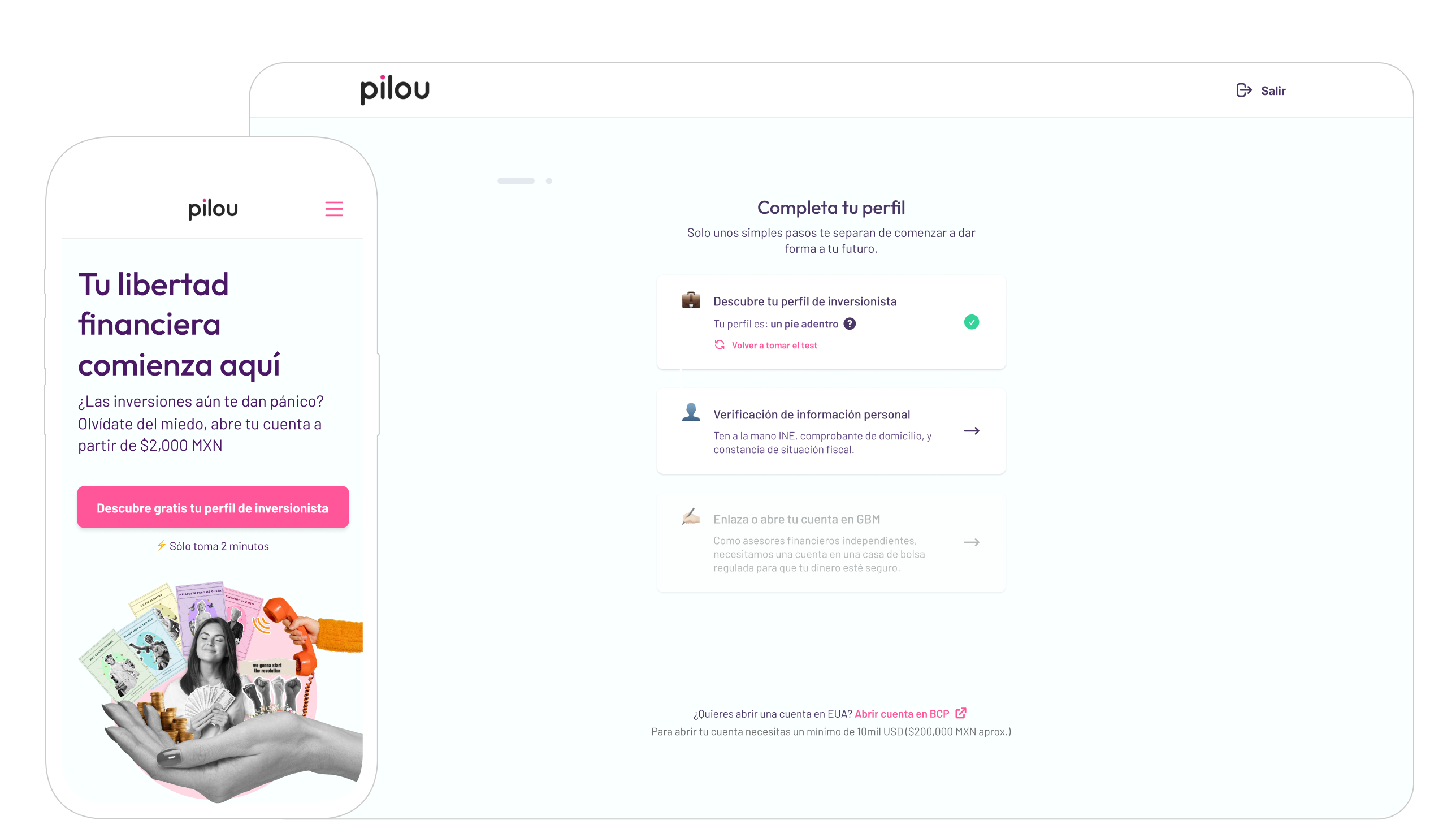

The Investor Profile Quiz: A New Beginning

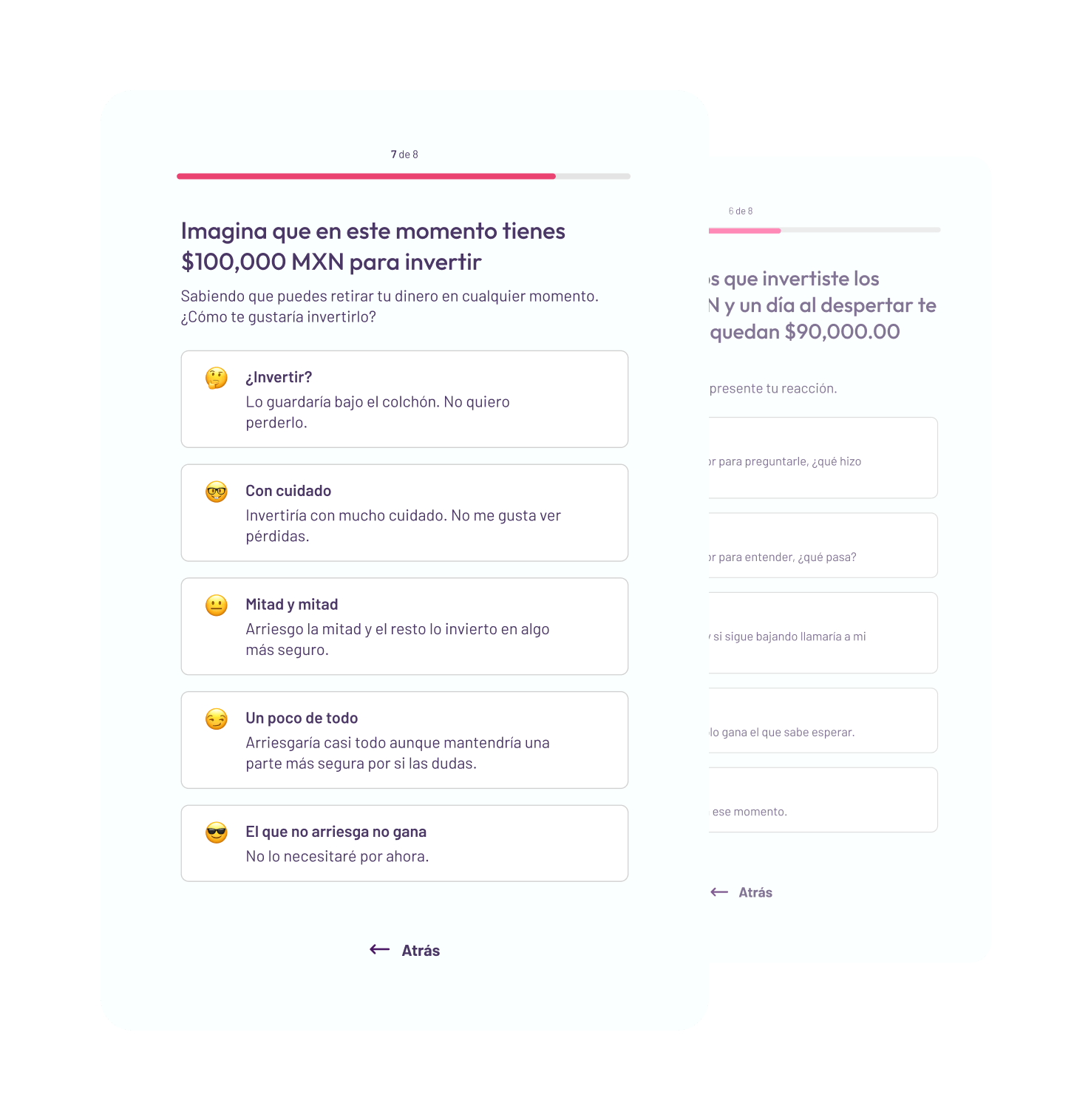

Our first major task was to remodel the very first step of the user onboarding flow: the Investor Profile Quiz. We streamlined the quiz by reducing the number of questions, focusing on more effective ones that could gather essential user data efficiently. This change was aimed at decreasing the time users spent on this initial step, reducing fatigue and the risk of losing their interest.

In addition, we enhanced the quiz’s performance to provide a smoother experience. The interface was updated to match our new product design direction, significantly improving user interaction. We also refined the system’s communication method for sharing profile results. Now, users are also encouraged to create an account with Pilou by receiving their results through a well-structured and informative email, making the whole process more engaging.

On the backend, we made critical adjustments to the scoring, risk assessment systems, and algorithms. These changes support key KYC (Know Your Customer) and AML (Anti-Money Laundering) purposes, ensuring that Pilou’s onboarding process is not only user-friendly but also compliant with essential financial regulations. This comprehensive revamp of the Investor Profile Quiz was a strategic step towards enhancing user engagement and streamlining the account creation process.

KYC and Digital Signatures

In the crucial task of selecting technical partners for the KYC and digital signature processes, we meticulously evaluated potential collaborators based on several key criteria.

Our decision-making process, conducted in close partnership with the Pilou team participating with them in all the meetings, prioritizing technical capability – particularly for seamless document validation crucial in the onboarding process – financial factors – including the cost per validation and anticipated future expenses tied to an expected increase in new users – and scalability and performance stability, given the anticipated growth of Pilou and the high demand that would place on the system.

Most importantly, compliance with regulatory requirements was a non-negotiable aspect, as we needed a partner capable of meeting all the necessary validation standards set by financial regulations. After extensive meetings, tests, and evaluations, we chose a company that met these comprehensive criteria. This careful selection ensured our partners were fully aligned with Pilou’s technical, financial, and regulatory needs.

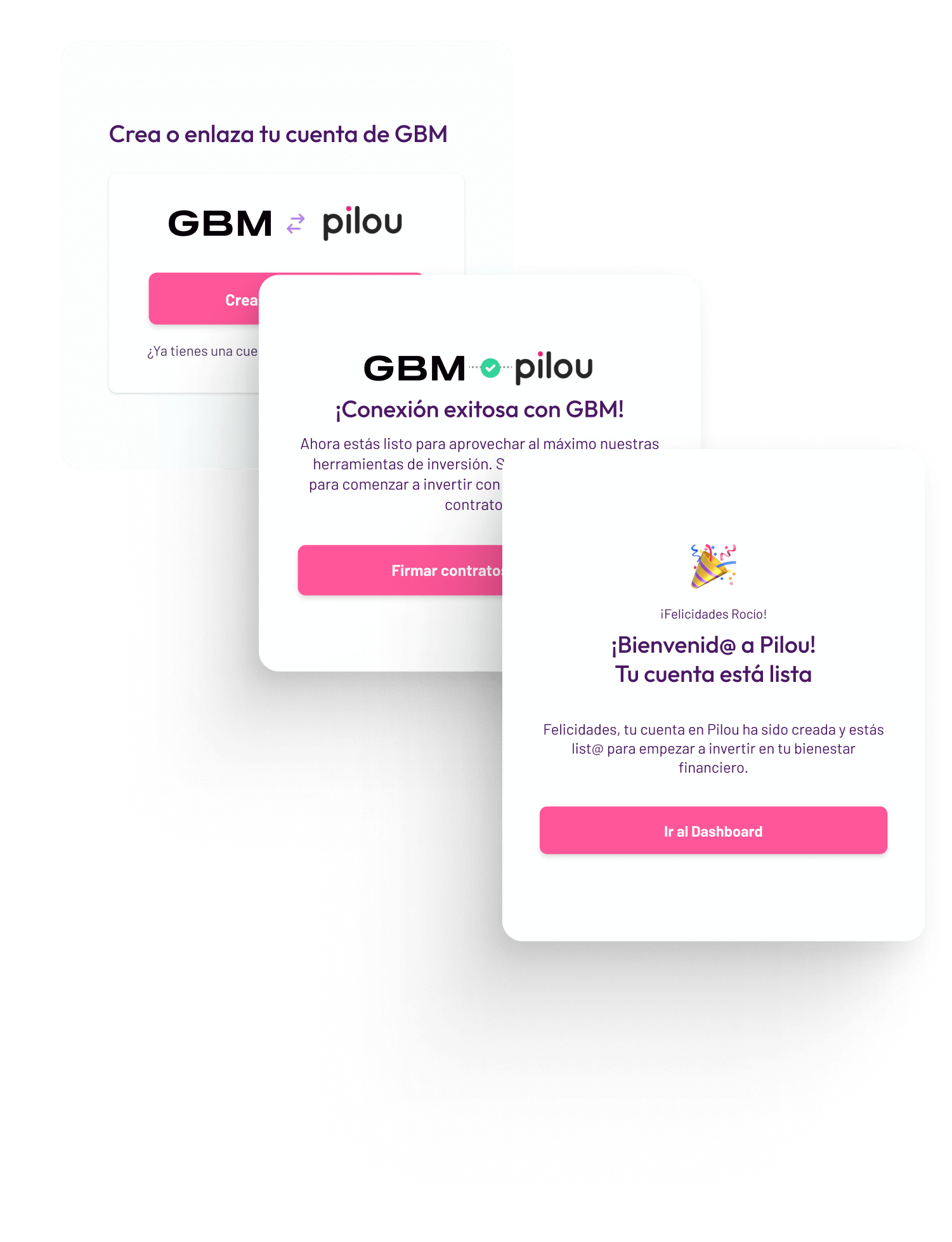

SDK Integrations

The SDK integration with a major Mexican bank played a significant role in refining Pilou’s onboarding process. By incorporating the bank’s Software Development Kit (SDK), we streamlined the account opening procedure, particularly benefiting users who already had accounts with the bank and wished to open an account with Pilou.

This integration was transformative, shifting from a process that previously took days to complete to a much faster and more efficient system. Before this integration, the account setup was handled manually, a time-consuming approach that often led to delays. The SDK integration marked a pivotal improvement in the user journey, reducing the time and effort required to onboard new clients significantly. This enhancement not only accelerated the process but also improved the overall user experience, making it more convenient and user-friendly.

During this entire integration process, the Nolte team played a crucial role as the primary liaison with the bank’s technical team. We managed all communications directly through their established channels, ensuring a smooth and coordinated effort. Our active involvement in these discussions and technical exchanges was instrumental in tailoring the integration to meet Pilou’s specific needs. This direct line of communication not only facilitated a more streamlined integration process but also allowed us to address any challenges promptly, optimizing the onboarding journey and significantly improving the overall user experience.

Regulatory and Compliance Mastery

In reworking Pilou’s platform, a significant focus was placed on understanding and adhering to Mexico’s financial regulations, including the CNBV’s requirements. This effort was far from superficial; it involved an in-depth study of the legislative landscape that shapes fintech operations in Mexico. Our approach was collaborative and rigorous, involving weekly meetings with Pilou’s compliance team. Together, we dissected the CNBV legislation to thoroughly grasp the operational intricacies of the financial sector in Mexico.

This collaboration led to the backend product development of various mechanisms, ensuring that Pilou’s new functionalities not only met but exceeded security standards and complied fully with regulatory demands. These changes, though not always visible to end-users, were crucial in fortifying the platform against potential risks and capitalizing on opportunities within the regulatory framework. This partnership between our teams was instrumental in ensuring that Pilou’s platform was not just user-friendly but also robustly secure and compliant with the complex financial regulations of Mexico.

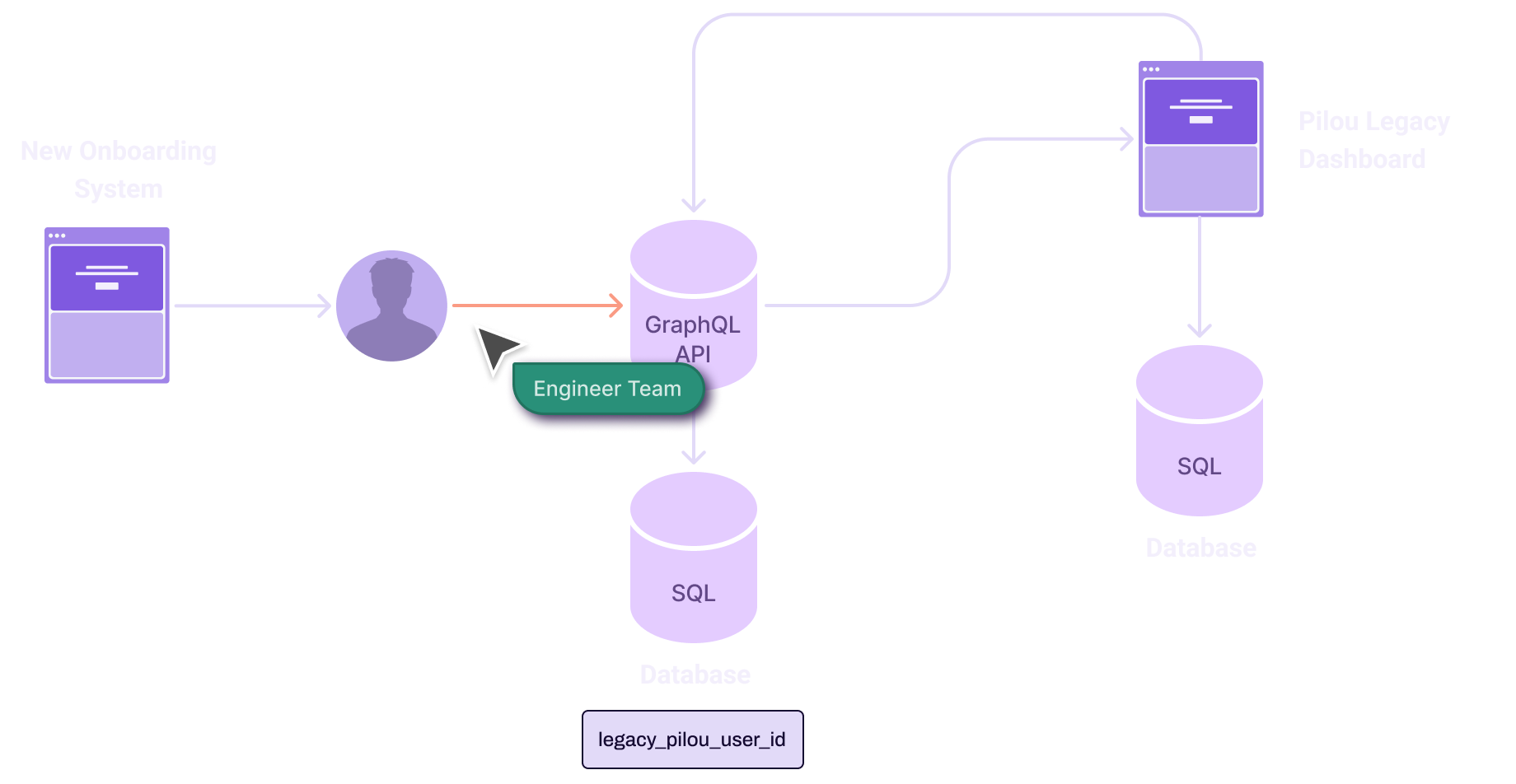

The Major Challenge: Bridging Different Tech Stacks to Preserve Coherent User Experience

The most formidable challenge we encountered in the Pilou project was the integration of two distinct technology stacks: the legacy dashboard developed in Ruby and the new onboarding system built with JavaScript frameworks (Next.js and Nest.js). This was aiming to bridging two separate worlds, each with its own language, architecture, and intricacies.

We started a thorough process to make sure users could move smoothly between the two systems. Our team set up a development environment to test how well the systems worked together. We created a secure API for user authentication and carefully managed Cross-Origin Resource Sharing to keep data sharing secure. It was important to maintain backward compatibility, so we made sure our updates worked well with the existing user experience. By adding API calls into Graphql, we made it easier to create and update user profiles, including KYC and investor profiles, simplifying the entire process.

Crucial to this endeavor was the seamless redirection of users to the legacy dashboard after onboarding, requiring a sophisticated mapping of missing fields and synchronization of data across disparate systems. This intricate work behind the scenes was pivotal in preserving a coherent user experience, allowing users to transition smoothly between systems without encountering the underlying complexities.

Final Results: A Transformation Manifested

Reflecting on the months of intense collaboration with the Pilou team, the fruits of our joint efforts have been nothing short of transformative. The journey was marked by challenges and opportunities; each met with innovative solutions that have reshaped the very core of Pilou’s technological infrastructure and user experience. The results of these months of rigorous product development and strategic planning were profound:

Scalable System Architecture

We transitioned to a more scalable architecture using modern technologies, enhancing modular service capabilities.

Robust Technical Documentation

Comprehensive documentation was created to facilitate future development and maintenance.

Enhanced Security and Code Quality

Security measures were fortified, and code quality was significantly improved, mitigating previous vulnerabilities.

Revolutionized Interface Product Design

Our comprehensive product redesign of Pilou’s user interface marked a significant evolution in the user journey. The website, the investor profile creation, and the account opening process were all enhanced for better navigation and visual coherence. Additionally, the email communications were refreshed to facilitate clearer user interactions.

A Brand New and Streamlined Onboarding Process

The new onboarding time was drastically reduced from an average of 20 minutes to 8 minutes, reflecting a more efficient and performative system and user-friendly process.

As our project with Pilou concludes, the tangible outcomes of our work together are clear and impactful. The improvements we implemented have streamlined Pilou’s operational processes, significantly enhancing the efficiency and effectiveness of their business operations. Our work in revamping the user onboarding process, integrating with a major Mexican bank, and enhancing the overall user interface, have not only improved Pilou’s brand perception but have also set a new benchmark in user engagement within the fintech sector.

These changes are more than superficial adjustments; they represent a fundamental shift in how Pilou operates, interacts with its customers, and positions itself in the market. Looking forward, these advancements lay a solid foundation for Pilou’s continued growth and success, with a platform now better equipped to adapt to and lead in the evolving world of fintech.